disposal of rpc shares in malaysia

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. An RPC is a company that.

For this purpose the disposal price will be the consideration received.

. RPGT treatment Mr X Mr Y and Mr Z are deemed to have each acquired 100000 RPC shares. A Malaysian citizen who disposes of a property after five years of ownership for a consideration sum of RM200000 or below is exempted from RPGT. Real Property Gains Tax RPGT is charged on gains arising from the disposal of real property situated in Malaysia or of interest options or other rights in a property as well as the.

However if the company disposes of its shares or real property to the point where its RPC share percentage falls below 75 and it ceases to be an RPC then the shares that are. Form CKHT 2A Acquisition of Real Property Shares in. The disposal price of the shares does not follow the normal disposal rules in the RPGT Act.

Mr X disposed of his 100000 shares on 10 October 2019 for RM1 million to Mr D. Legal fees and other costs. Real Property Gains Tax RPGT is a capital gains tax imposed on gains on disposals of real property located in Malaysia or shares in an RPC.

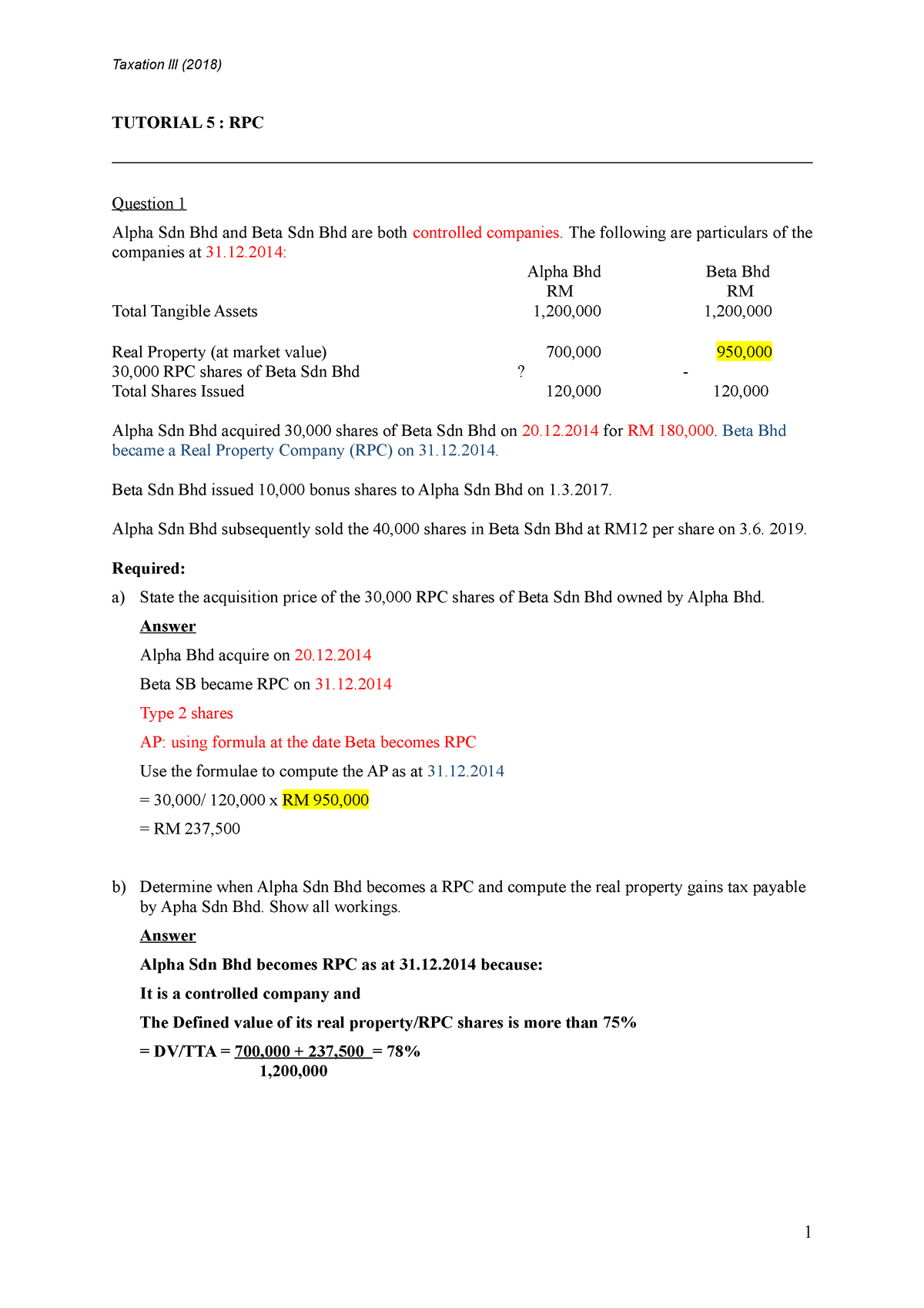

A taxable gain and RPGT will be assessed if the. The target company will be regarded as a real property company RPC if it owns real property real estate or shares in RPC or both whereby the market value of these is not less than 75. Once a share is classified as an RPC share it shall always remain an RPC share for the shareholder despite the company relinquishing its RPC status.

However if the company sells its shares or real. With effect from 12102019 where a disposal is subject to tax under Part I of Schedule 5 references to 111970 shall be construed as references to 112013. Binastra Though the law under paragraph 34A is clear in taxing disposal of RPC shares equally clear is the intention behind parliaments amendment to the RPGTA.

Form CKHT 1B Disposal of share in Real Property Companies RPC Besides the disposer must also ensure that the buyer submits. On gains arising from the disposal of real property situated in Malaysia or shares in a real property company RPC. RPGT is also charged on the disposal of shares in a real property company RPC.

An RPC company constitutes only if it has real property 1 or RPC shares amounting to no less than 75 of its companys total tangible assets. So your company is considered a Real Property Company RPC and when you sell shares the gain from the disposal will be subject to RPGT. Disposal Price The amount of the consideration in money or moneys worth for the disposition of RPC shares is referred to as the disposal price.

Depending on the period of ownership these gains will be subject to RPGT at. Real property is defined. Disposal or acquisition of the RPC shares.

RM 192 Mil - RM 1 Mil RM 920000. Property Companies RPC SUBMISSION OF RPGT FORM DISPOSAL NOT LIABLE TO RPGT Includes. However if the company disposes of its.

The disposal of such shares will. An RPC is a company holding real property or shares in another RPC with value not less than 75 of the. In some cases the disposal price of the RPC share may also be deemed to be the market value of the RPC shares10 Acquiring an RPC Under the RPGT.

Calculate the number of years and Identify the RPGT percentage. An RPC company means that it has real property or RPC shares that are more than or equal to 75 of its companys total tangible assets. Under the law an RPC is defined as a controlled company whose total tangible assets is at least 75 real property shares in real property companies or both.

If the same RPC shares continue to be held by the same person even though the RPC may have ceased to be an RPC the disposer of such shares will still be charged with. For disposal of a property acquired. Chargeable gain Sale Disposal price -Purchase Acquisition price.

Disposal made after 5 years from the date of acquisition of the property by persons.

Busi3083 Taxation 2 Unm Full Notes Including Examples Busi 3083 Taxation 2 Unmc Thinkswap

Tutorial 5 Tutorial 5 Rpc Question 1 Alpha Sdn Bhd And Beta Sdn Bhd Are Both Controlled Studocu

Tutorial 4 Prgt Xlsx A According To Para 3 B Sch 2 An Individual Who Transfer Real Property To A Company Controlled By Him And Or His W Owned May Course Hero

Real Property Gains Tax 101 Malaysian Taxation 101

Malaysia Taxation Of Cross Border M A Kpmg Global

Real Property Gains Tax In Malaysia In 2010 Pdf

Real Property Gains Tax Rpgt In Malaysia 2022

Rpgt Of Selling Property In Malaysia Race4home Com My

Real Property Gains Tax Rpgt Guide For The Year 2020 2021 In Malaysia

Transfer Of Shares In A Real Property Company Donovan Ho

Rpgt 1976 Rpgt 1976 Tuesday 11 8 Wednesday 12 Real Property Gains Tax 1976 In Malaysia We Studocu

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Understanding Real Property Gains Tax Penang Property Talk

Pitfalls Of Holding Real Property Company Shares

Lhdn St Partners Plt Chartered Accountants Malaysia Facebook

2015 Mergers And Acquisitions Report Malaysia Iflr

Comments

Post a Comment